The Illinois Real Estate Property Tax Bill Formula

Assessment Value * Tax Rate * Multiplier = Real Estate Property Tax Bill per Property

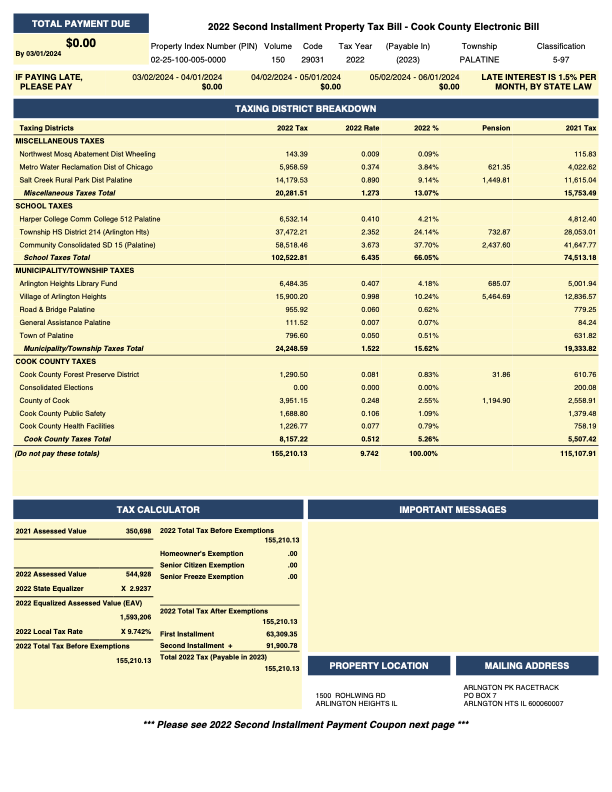

Where Real Estate Property Taxes are allocated

In summary, there are four categories of Taxing Districts; Miscellaneous Taxes, School Taxes, Municipality/Township Taxes, Cook County Taxes. The itemized “Taxing District Breakdown” displays line item detail.

The first-installment bill is simply a 55% version of the second-installment bill from the prior tax-year.

The 2nd-Installment bill details your share of the annual levy. The taxes due will show a credit of the 1st-Installment.

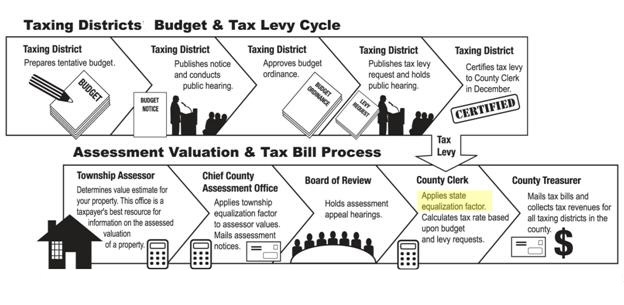

How the Property Tax Levy is Calculated

Annually thousands of governments, school districts, municipalities, townships, park districts, library districts, and etcetera each determine the amount they need to collect from property taxes to operate.

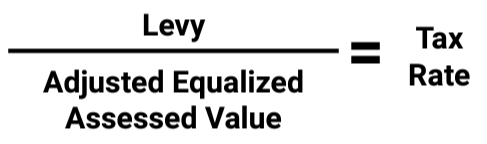

How the Real Estate Tax Rate is Calculated

Tax rates are calculated by dividing the budget by the assessment values.

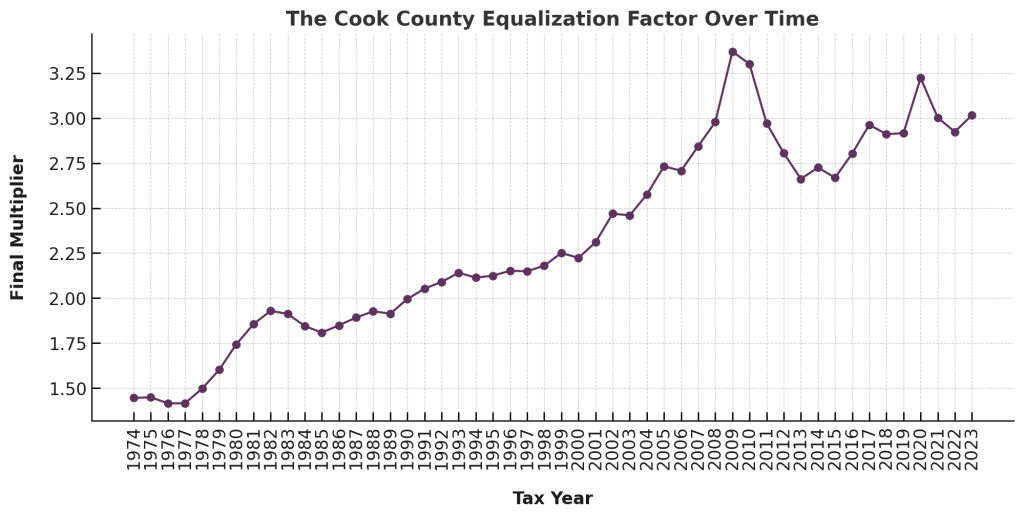

How the Equalizer (Multiplier) is Calculated

The state of Illinois is required to ensure that the property tax burden is distributed equally among property owners throughout Illinois. Their requirement is that all assessments reflect the same percentage of fair cash value. To accomplish this, the Illinois Department of Revenue “equalizes” assessments across the state so that they are uniform at 33 1/3% of fair cash value.

The equalization process consists of an “assessment/sales ratio study” that compares a sampling of assessment to actual sales, to see if assessments were accurate, while also accounting for the differing percentages of assessed values.

Non-Cook County:

Fair Market Value * 33.33% = Assessment Value

Cook County:

Residential Fair Market Value * 10% = Assessment Value

Commercial Fair Market Value * 25% = Assessment Value

Assessors strive to value all property at 33.33%, when they get it right the equalizer is simply set to “1”. However when they miss the mark, the Illinois Department of Revenue implements their correcting “equalizer” to a value greater than one to in effect bring the assessment up as under-assessments are far more common than over-assessments.

In Cook County, for the last twenty years, the equalizer has been greater than two and sometimes it has surpassed a value of three. This is in part because under-assessments are most common in addition to the fact that all residential property is assessed at 10%, and commercial and industrial properties are assessed at 25%.

When the Equalizer (also known as a Multiplier) is set

The equalizer is set right after the tax levy is set.

When Real Estate Tax Bills are Dispatched and Due

The annual property tax bill is separated into two installments. Cook County and some other Illinois counties use this billing method. Under this two installment system, the first installment of taxes is 55% of last year’s tax bill and is mailed by January 31st and is due by March 1st. Illinois counties outside of Cook County may set a due date as late as June 1st.

The second installment is prepared and mailed around June 30th and is for the balance of taxes due. The balance is calculated by subtracting the first installment from the total taxes due for the present year. The second installment is generally due August 1st or at a later date as set by the county.

What happens if you don’t pay your Real Estate Taxes

Tax Delinquency:

If you do not pay your property taxes, you could lose your property to tax foreclosure. In order, the process goes from tax delinquent -> tax lien -> tax auction -> tax foreclosure.

Tax Lien:

The county will put a lien against your property for the amount of delinquent taxes owed.

Tax Auction:

The county can then sell the lien to a tax buyer, who steps in to pay the overdue taxes to the county on behalf of the owner for the benefit of earning interest on the lien certificate purchased and also having rights to tax foreclose if they’re not paid back.

Tax Foreclosure:

If the property owner doesn’t redeem their taxes by paying the delinquent tax amount plus the interest, within 2.5 years, the tax buyer may pursue the tax deed in court. Upon being granted the tax deed, the tax buyer then becomes the legal owner of the property.

Peace Out.

###

Hire Us to Handle Your Appeal

Want experts to handle your tax appeal for you? We work on contingency, so you only pay if we win. There’s no risk and $0 required upfront.

Work With Us

Want to help property owners reduce their tax burden? We train practitioners and provide cutting-edge software tools to help you succeed in this industry.

The Real Estate Tax Newsletter

Get exclusive updates, insider strategies, and expert insights on real estate tax appeals delivered straight to your inbox. Whether you’re a property owner looking to cut costs or a professional in the industry, our newsletter keeps you informed and ahead of the game.

✔ Pro tips for lowering your property taxes

✔ Breaking news on tax assessment changes

✔ Data-driven insights from industry experts

Join now and never miss a key update.

The Real Estate Tax Newsletter

From Fortune 500 companies to boutique law firms, I’ve spent over a decade navigating the real estate tax world. Since 2014, I’ve been mastering the game, and now, through this blog, I break down complex tax concepts into plain English, giving you the knowledge you need to take control. No fluff, just value.